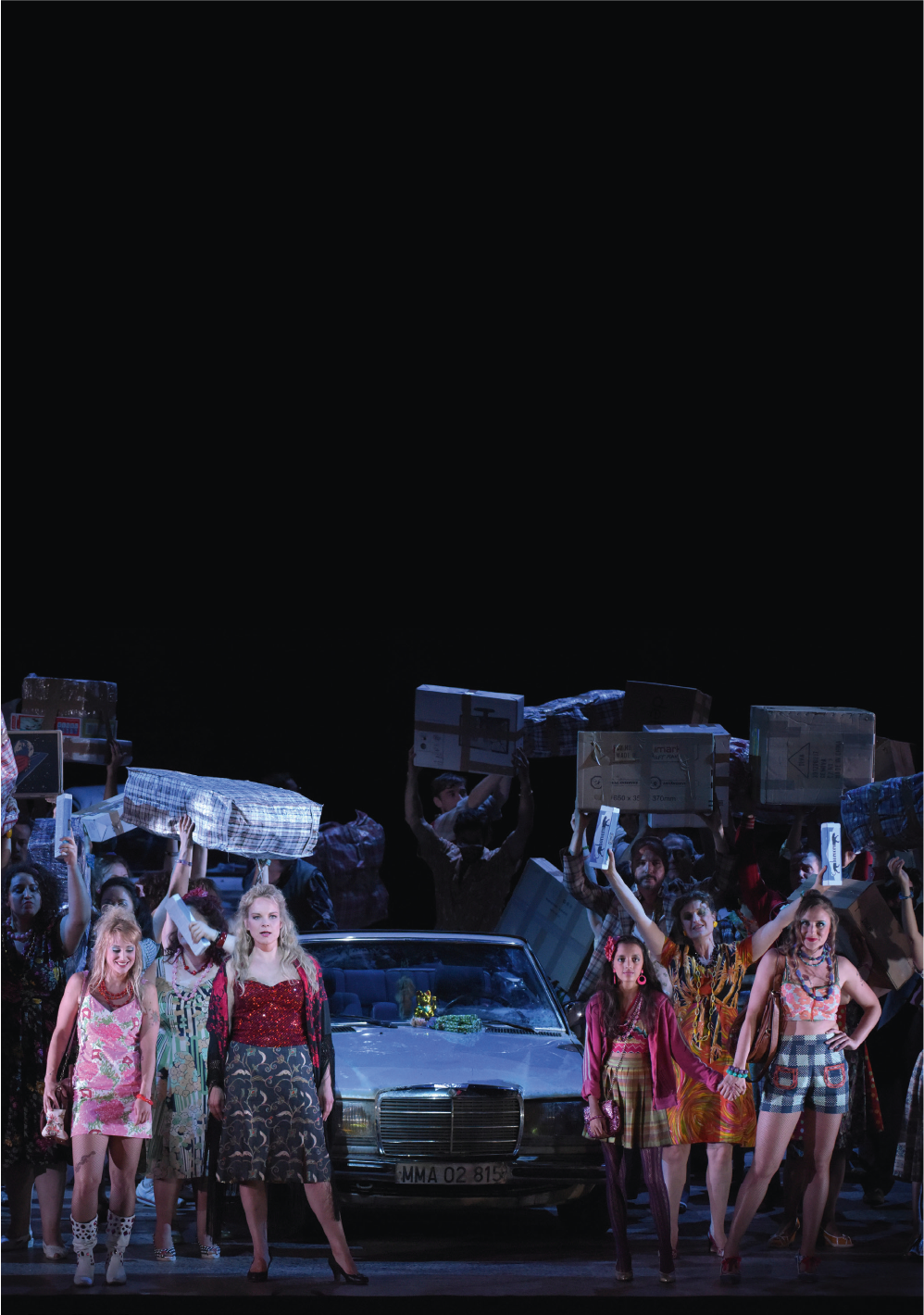

Become a Friend of the Opera

Join the Friends of the Opera and support the Opera while gaining privileged priority access to all shows, backstage tours and artists talks.

The Friends of the Paris Opera brings together more than 4000 opera and

ballet lovers, both individuals and companies, who wish to support the Paris

Opera and be closely associated with its activities. AROP contributes

actively to the artistic vitality and influence of the Paris Opera. With the

funds it collects each year, the association supports productions, Paris Opera

Orchestra and Ballet tours, educational programmes, the Paris Opera Academy,

the Ballet School, the 3e Scene…

Back to top